owner's draw vs salary uk

If you draw 30000 then your owners equity goes down to 45000. An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company LLC or S corporation by the owner for their personal use.

Salary Or Draw How To Pay Yourself As A Business Owner Or Llc Quickbooks

Owners equity is made up of any funds that have been invested in the business the individuals share of any profit as well as any deductions that have been made out of the account.

. Updated on July 30 2020. Dividends paid by a company to a shareholder out of after-tax profits are taxable for that shareholder. As a business owner you can receive compensation for your work in your company through an owners draw or a salary.

On the other hand a payroll salary offers more stability and less planning at the expense of less flexibility. Instead you make a withdrawal from your owners equity. Through the salary method youll receive a fixed amount of money regularly as an employee.

You have total control over how much you take from the business on a regular basis and this can include amounts over this years profits. Many business owners opt to take a salary as a more stable form of payment. Owners Draw Taxes.

Lets say our friend Charlie decides to pay himself on a payroll salary. The flexibility of owners draw can be very attractive but it can also be a risk. You pay yourself a regular salary just as you would an employee of the company.

In contrast the draw method allows you to withdraw from your owners equity account as your profits increase. An owners draw is an amount of money taken out from a sole proprietorship partnership limited liability company LLC or S corporation by the owner for their personal use. The two most common methods of compensation are an owners draw and a salary.

If you draw 30000 then your owners equity goes down to 45000. The Internal Revenue Service IRS also requires that you pay your own self-employment taxes Social Security and Medicare taxes and estimated taxes. Owners draws can be scheduled at regular intervals or taken only when needed.

Taking Money Out of an S-Corp. There are two journal entries for Owners Drawing account. In addition payroll counts as a necessary tax-deductible business expense.

Taking Money Out of an S-Corp. If the company has already paid tax and franking credits on the dividend are. Because your company is paying half of your Social Security and Medicare taxes youll only pay 765 half what youll pay if you take an owners draw.

Are infrequent in nature. Is it a draw or a salary. Learn more about owners draw vs payroll salary and how to pay yourself as a small business owner.

Because their personal finances and business finances are so closely linked sole traders can make. At year-end credit the Owners Drawing account to close it for the year and transfer the balance with a debit to the Owners Equity account. If you pay yourself a salary like any other employee all federal state Social Security and Medicare taxes will be automatically taken out of your paycheck.

So if she chose to draw 40000 her owners equity would now be 40000. Salaries paid are tax deductible for your company reducing its profits and taxable income and therefore the amount of company tax it pays. By Toni Cameron On October 17 2019 February 4 2022.

Owners can withdraw money from the business at any time. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. This is an essential factor for your owners draw vs salary decision.

As we outline some of the details below. Patty can choose to take an owners draw at any time. That means that an owner can take a draw from the business up to the amount of the owners investment in the business.

At the time of the distribution of funds to an owner debit the Owners Drawing account and credit the Cash in Bank account. Owners drawing owners draw or simply draw is a method of taking out money from a business by its owners. Wages are seen as an allowable business expense and are tax-deductible.

If Charlie takes out 100000 worth of an owners draw he runs the risk of not being able to pay employees salaries fabric costs and other various expenses. All wages need to be calculated and recorded through PAYE. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

Drawings are made by sole traders from their business accounts and are seen as the sole traders personal income. Heres a high-level look at the difference between a. Are usually either for estimated taxes due to a specific event or from business growth.

For certain business structures there is no restriction on owners to withdraw money from the business as and when needed. Payroll salaries are subject to income tax so owners dont have to worry about paying self-employment tax. Its a way for them to pay themselves instead of taking a salary.

Convenient for your mortgage. Owners draw is a method of paying yourself as an. One of the main differences between paying yourself a salary and taking an owners draw is the tax implications.

An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. Risk of Large Draws. With owners draw you have to pay income tax on all your profits for the year regardless of the amount you actually draw.

Small business owners should learn about the circumstances under which they. She could choose to take some or even all of her 80000 owners equity balance out of the business and the draw amount would reduce her equity balance.

Get Paid To Draw Online 34 Sites That Pay Real Cash In 2022

Why Are Salaries In The Uk Europe So Low Is The Cost Of Living Generally Lower Than The Us Quora

Business Owner Salary Vs Owner S Draw How To Pay Yourself As A Business Owner Quickbooks Uk

How Men And Women View Money Differently Infographic

Salary Or Draw How To Pay Yourself As A Business Owner Or Llc Quickbooks

Salary Increment Letter Template Free Payslip Templates

How To Pay Yourself From Your Small Business Legalzoom Com

Letter Building Templates 3 Templates Example

Pakistan Air Force Ranks And Salary

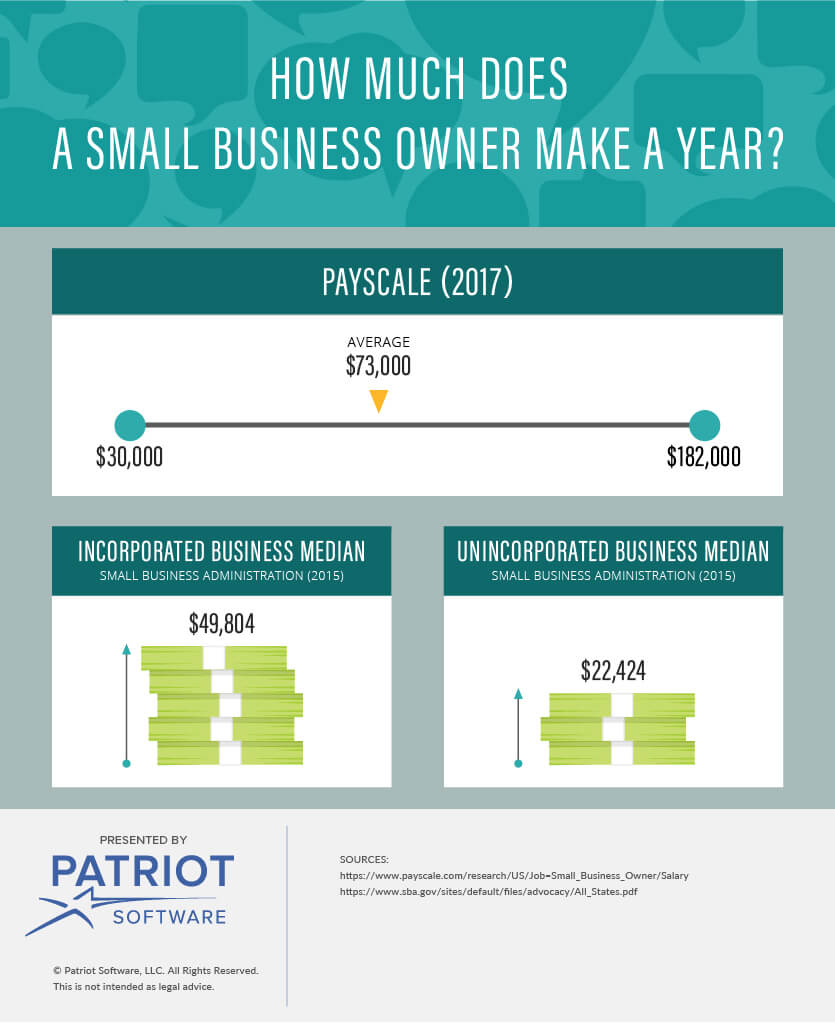

How Much Do Small Business Owners Make Surprising Averages

Template Net Business Start Up Cost Template 5 Free Word Excel Documents 72629afa Resume Business Budget Template Startup Business Plan Business Plan Template

Costum Internship Email Template Doc Sample Email Templates Advertising Strategies Email Marketing Strategy

The Salary Of Consultants In The Uk Consulting Industry

What Is A Prorated Salary And When Should I Use It Hourly Inc

Payroll Domain Payroll Payday App Financial

Privacy Policy For Influencers Bloggers And Online Business Owners In 2020 Online Business Business Owner Privacy Policy